us exit tax for dual citizens

How do loans help us save income tax in INDIA. Do you want us to call back Please fill the form below.

972 2 630-4070 Email.

. Get a Call Back. Once any available annual exclusions or marital or other deductions are utilized the available exemption will offset taxable gifts or bequests. 972 2 630-4000 Emergency After-Hours Telephone.

US estate and gift tax. Following find more information in this regard. Embassy Jerusalem 14 David Flusser Street Jerusalem 93392 Telephone.

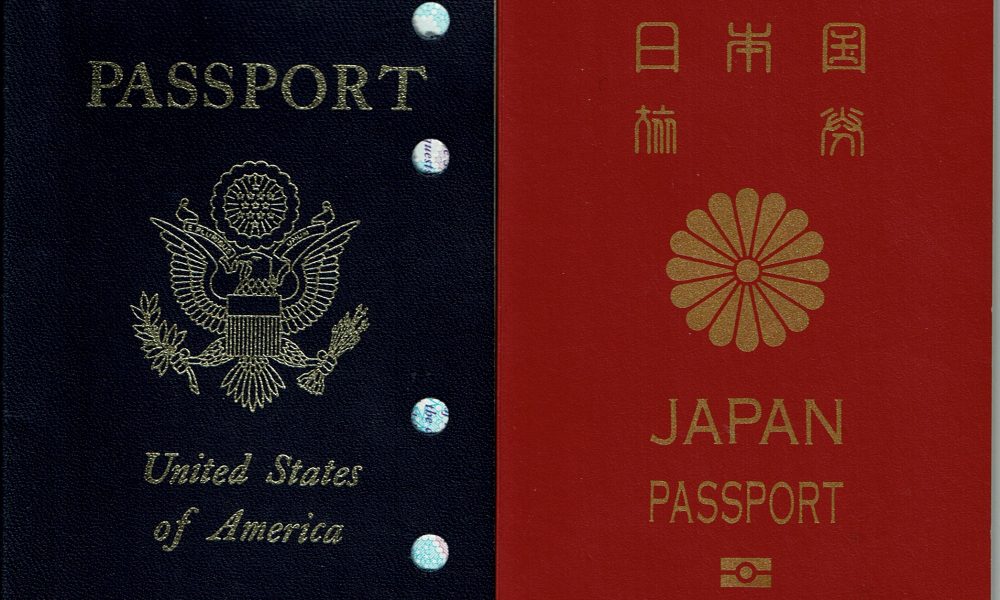

Multipledual citizenship or multipledual nationality is a legal status in which a person is concurrently regarded as a national or citizen of more than one country under the laws of those countries. 972 3 519-7551 Fax. And you may be subject to Exit Taxes under IRC 877A.

Citizens or green card holders who terminate. As mentioned earlier the exemption amount is 11400000 in 2019. A resident of the United States for tax purposes if they meet either the green card test or the substantial presence test for the calendar year.

Conceptually citizenship is focused on the internal political life of the country and nationality is a matter of international dealings. Passport to enter Dominica. However not all US residents and US citizens can enter Europe visa-free due to their nationality and their situation.

US estate and gift taxes. Embassy in Jerusalem for information and assistance in Jerusalem the West Bank Gaza and the. Income Tax Slab Rates for Senior Citizens 60 to 80 Years for FY 21-22 AY 22-23.

A benefit on early exit is available under Plan Option Life Secure of iSelect Smart360 Term Plan. Passports and visa. As per the foreign nationals residing in the US on a temporary or permanent residence permit the following do not need to obtain a visa to enter Europe.

Citizens must have a valid US. No visa is required for stays less than 6 months if you have an onward or return ticket confirmation of accommodation and can produce evidence of your ability to maintain yourself. JerusalemACSstategov Contact the Consular Section of the US.

There is a departure tax of US 22 assessed when leaving Dominica. For inquiries please contact us at. There is no international convention which.

Income Slabs Old Regime. This one imposes the income tax on the net unrealized gain on property held by certain US. Assistance to Nationals Hotline.

Do Dual Us Citizens Have To File Us Taxes

Tax Guide For Dual Citizens Of The Us And Uk Greenback Expat Tax Services

Do Dual Citizens Renouncing Us Citizenship Pay Expatriation Tax

Tax Filing For Dual Citizenship Expat Cpa

Form 8833 Tax Treaties Understanding Your Us Tax Return

Bookmark Japanese Citizenship Or Dual Nationality Everything You Need To Know Japan Forward

Irs Dual Citizenship Taxes A Quick Reference Guide For Expats

The Dual Citizen Exception To The Exit Tax Expat Tax Professionals

Renunciation Of Citizenship Answered Expat Us Tax

Taxes For Dual Status And Resident Aliens H R Block

How To Expatriate From The United States New 2021

Traveling As A Dual National Stick To The Rules And You Should Be By Philip Valenta Msf Traveleptica Medium

What Is Form 8854 The Initial And Annual Expatriation Statement

What Dual Citizens Need To Know Before You Renounce Us Citizenship

Green Card Exit Tax Abandonment After 8 Years

What Are The Benefits Of Dual Citizenship In 2022

Taxes For Dual Status And Resident Aliens H R Block

Dual Citizenship Exception To Expatriation Substantial Contacts